About Sam For CPAs

Reduce Tax Preparation Costs By Up To 50%.

Getting Preparers Has Never Been Easier

Tax Returns Completed Within 48 Hours*

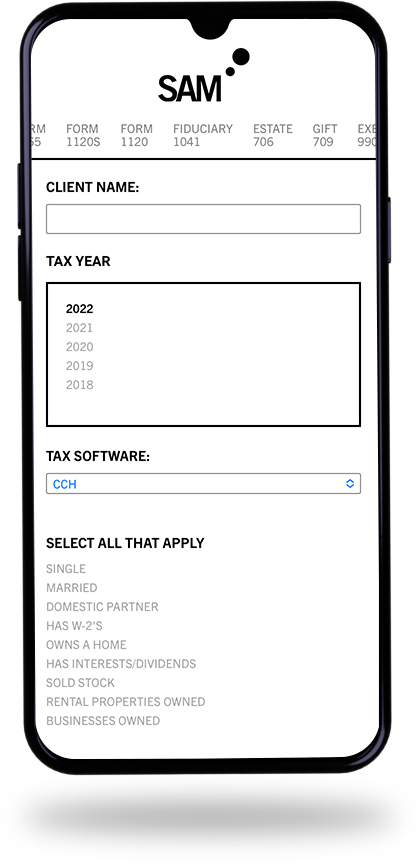

Simple To Use App - No Contracts, No Minimums

What SAM Offers

✓ A simple solution for your firm to increase profits by up to 60%!

✓ Bank-Grade TLS 1.3 and 256-Bit Encryption ensures privacy and safety.

✓ Full range of financial services to supplement the outstanding work your firm already provides.

How Does It Work?

Why Should I Join?

Improve Your Bottom Line

Reduce Your Seasonal Tax Preparer Cost By Over 50%.

Increase Your Firm's Efficiency

Less Time Spent On Preparing Means More Time For Your Team To Focus On Your Business.

Increase Client Retention

Delight Your Clients With A Cutting-Edge, Professional Tax Preparation Experience Via Our App.

Access To Quality Tax Preparers

We Have Strict Preparer Eligibility And Quality Assurance Standards, So You Can Trust Their Work.

Security & Data Info

• SAM values your firm's AND client's security and privacy. That's why we have developed a Banking-Grade TLS 1.3 Encrypted platform ensuring safety and security from potential cyber risks.

• Most up-to-date security protocol supported by a large range of internet browsers such as Chrome, Safari, Edge, Firefox, and IE6. All sensitive data including passwords, files, and credit cards are 256-bit encrypted and stored at rest.

• SAM stores encrypted data in "Allow-Only" lists allowing access only to known server connections.

• Access Keys and Passwords use one-way hashing and a zero-knowledge approach, making them impossible (Including SAM) to determine once stored.

• SAM uses artificial and business intelligence to improve security, function, and simplicity in real time.

• SAM's Engineering team has over 25+ years in global software management and Cybersecurity.

FAQs

Please email us at info@mysamadmin.com if you cannot find an answer to your question.

-

A "Ticket" tracks a tax return you submit to be prepared as it flows through the system. The ticket will have all information pertaining to your tax return: ticket number, ticket fee, your ticket selections, source documents, tax software file, notes to preparer, etc. You will also receive preparer feedback on a return through the ticket.

-

Our Cloud Preparers are collectively called a “Pool” AND it is also where tickets are awaiting to be picked up by a Cloud Preparer.

-

In the following year you will have the ability to request the same preparer, subject to the preparer availability. Preparers can only process 5 tickets at any given time.

-

We will provide this service for an additional charge. The fee to opt for this service will show up when a ticket is created.

-

You can reach out to our admin team (tickets@mysamadmin.com) and they can follow up with the preparer. If need be, it will be resubmitted to the pool at no extra charge to you.

-

A SAM Wallet Credit is applied to your SAM Wallet and may be used like normal deposited funds; HOWEVER cannot be withdrawn from the SAM Wallet and may only be used for Tax Outsourcing Services.

-

No. Once the preparer has completed the tax return and the ticket is sent back to the firm, you will receive the tax file with the completed return. Edits can be made at this time.

-

No. Firms are responsible for reviewing and E-filing the completed returns under their own tax software license.

-

SAM accepts the following tax software: Lacerte, CCH, Ultra Tax, Drake and ProSeries. All firms must have their own tax software licenses to access our platform. SAM does not efile any tax returns.

-

Yes. We have live team members in the U.S. that you may reach at (855) SAM-1065 or e-mail info@mysamadmin.com if you run into any challenges.

-

During tax season, our customer service department will be available by phone to meet your busy deadlines from 6:00am - 11:00pm (EST & PST). Our phone number is (855) SAM-1065.

-

We anticipate this platform being launched in the summer of 2023.

-

Our "White Label" is the ability to add any or all of your clients onto their own app, which allows them to upload their documents, track the status of their return and pay at the time the return is submitted (eliminating WIP and AR). The app will be white labeled with your firm name. This feature will be available at the same time as the Business Advisory/E-Commerce platform is launched.

-

Tax Research Projects are one of SAM's many Firm resource tools and a simple way to have our experts research, find answers and properly document it for tax law, case law, etc. when a client is too busy.

Our Tax Research Projects are only offered to our most experienced CPA's with a minimum of 10 years tax experience and who have extensive experience in tax research and tax court cases. These projects are provided in a format showing Facts, Question, Analysis and Conclusion with all the applicable documents provided. The 48 hour completion rule does not apply but instead, the CPA assigns a specific due date that will be reflected in your tax research ticket.

THE SOLUTION For The Tax & Accounting Industry

The SAM Marketplace is Changing The Way CPAs Do Business Forever. Are You Ready To Join Us?