Tax Planning

Expect the unexpected.

With tax laws constantly changing, Tax Planning can help clients minimize their tax liabilities and maximize their returns, leading to increased client loyalty and satisfaction.

Offering tax planning services can lead to increased revenue streams for your firm, as clients may require ongoing tax planning services throughout the year.

Overall, adding tax planning as a service can help the CPA firm provide more value to its clients while also increasing its profitability.

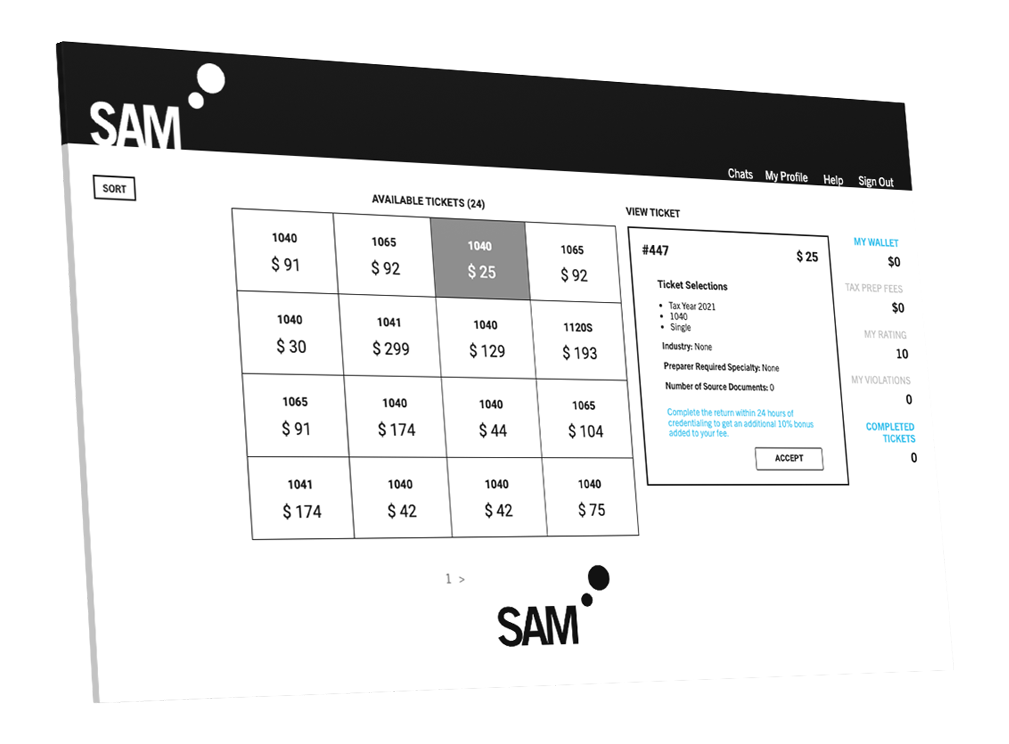

About SAM Tax Planning

Are you looking for ways to stand out in the crowded CPA market and attract new clients while keeping existing clients satisfied and loyal?

Adding tax planning as a service to your existing CPA firm could be the game-changer you need. With the constantly changing tax laws, providing tax planning services can help your clients minimize their tax liabilities and maximize their returns. Your clients will appreciate the value you bring and stick with you for the long term. Your firm will set itself apart from the competition and attract new business while also adding to your bottom line. It's a win-win situation that benefits everyone involved.

Start outsourcing your tax planning through SAM today and see the positive results for yourself. Like all of SAM’s other services and features, there is no minimum, no contracts, and no upfront fees to start.

No Contracts, Minimums, or Upfront Fees to Sign Up

No Preparer/Client Contact - Your Firm’s Clients are Yours

No Risk, No Commitment, No Hassle

No Upfront Fees to Sign Up!

Pay For Only What You Use.

THE SOLUTION For The Tax & Accounting Industry

The SAM Marketplace is Changing The Way CPAs Do Business Forever. Are You Ready To Join Us?